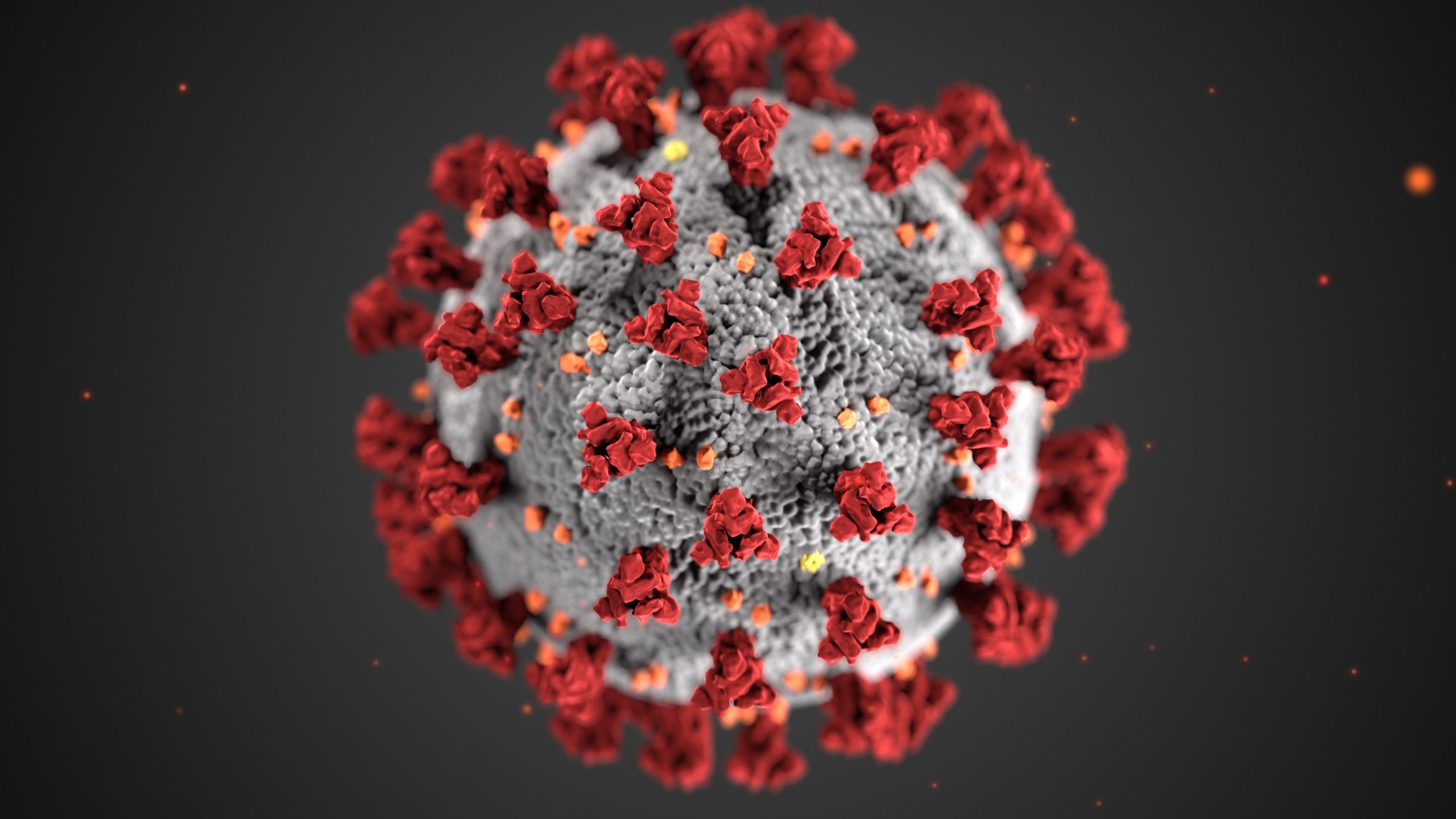

coronavirus_update

3 Sources of Federal Relief for Small Businesses

Economic Injury Disaster Loans (EIDL) through the SBA The Coronavirus Preparedness and Response Supplemental Appropriations Act provided $1Billion of loan subsidies for the SBA Economic Injury Disaster Loan program for small business entities financial impacted as a result of the coronavirus. Please see our post here for more information about the program and how to…

Read MoreFor Individuals: New COVID-19 Federal Assistance – CARES Act

Summary of Keypoints Overview of the CARES Act for individuals: The CARES Act, enacted on March 27, 2020, provides economic relief aimed at helping individuals and families manage the financial effects of the COVID-19 pandemic, with provisions summarized as guidance available at the time. Retirement plan relief: Individuals may take coronavirus-related retirement plan distributions of…

Read MoreFor Small Businesses: New COVID-19 Federal Assistance – CARES Act

Summary of Keypoints Overview of CARES Act relief for small businesses: The CARES Act, enacted March 27, 2020, provides payroll, rent, and cash-flow relief for small businesses, including loan forgiveness for eligible expenses and the option to defer employer Social Security tax payments over two years. Paycheck Protection Program (PPP) and loan forgiveness: The Act…

Read MoreHelp for Small Businesses in Maryland

Summary of Keypoints Overview of Maryland small business relief: Maryland offers two COVID-19 emergency assistance programs for small businesses and nonprofits with fewer than 50 employees: an emergency relief grant fund and an emergency relief loan fund. Maryland Small Business COVID-19 Emergency Relief Grant Fund ($50M): This program provides grants of up to $10,000 to…

Read MoreVirginia Unemployment Web Based Assistance

Fairfax County Help For Businesses due to Covid-19

Summary of Keypoints Overview of Fairfax County business assistance: Fairfax County provides COVID-19-related relief measures aimed at supporting local businesses impacted by the pandemic. Tax deadline extensions: Fairfax County extended deadlines for certain local taxes, including car (business personal property) taxes and real estate taxes, to help ease short-term cash flow pressures for businesses. Purpose…

Read MoreResources for Small Businesses – SBA EIDL Funding

Summary of Keypoints Overview of SBA Economic Injury Disaster Loans (EIDL): The U.S. Small Business Administration offers low-interest federal disaster loans of up to $2 million to help small businesses experiencing substantial economic injury due to COVID-19. Purpose and use of funds: EIDL funding is intended to provide working capital to support ongoing business operations…

Read MoreTax Credits Provided to Small Businesses

Summary of Keypoints Overview of FFCRA tax credits for small businesses: The Families First Coronavirus Response Act requires small businesses to provide paid sick leave and emergency family and medical leave, while offering refundable payroll tax credits to offset the cost of these required wages. Scope and timing of credits: The FFCRA provides a 100%…

Read MoreFamilies First Emergency Family and Medical Leave Expansion Act

Summary of Keypoints Overview of Families First emergency leave requirements: The Families First Emergency Family and Medical Leave Expansion Act (EFMLEA) and the Emergency Paid Sick Leave Act (EPSLA) require employers with fewer than 500 employees to provide paid leave related to COVID-19, with potential exemptions for employers with fewer than 50 employees if compliance…

Read MoreSBA EIDL Help for Small Businesses

Summary of Keypoints Overview of SBA Economic Injury Disaster Loans (EIDL): Under the Coronavirus Preparedness and Response Supplemental Appropriations Act of 2020, the SBA provides low-interest federal disaster loans to small businesses experiencing substantial economic injury due to COVID-19. Loan purpose and use of funds: EIDL proceeds may be used for working capital needs, including…

Read More