Corporate

Accounting for Nonprofits vs For-Profits: An Advisor’s Perspective

Summary of Keypoints Nonprofit and for-profit organizations differ fundamentally in purpose and taxation, with nonprofits operating for public or social benefit and generally exempt from income tax, while for-profits exist to generate profit for owners and are subject to income taxes. Financial statement structures differ significantly: Nonprofits use a statement of financial position, statement of…

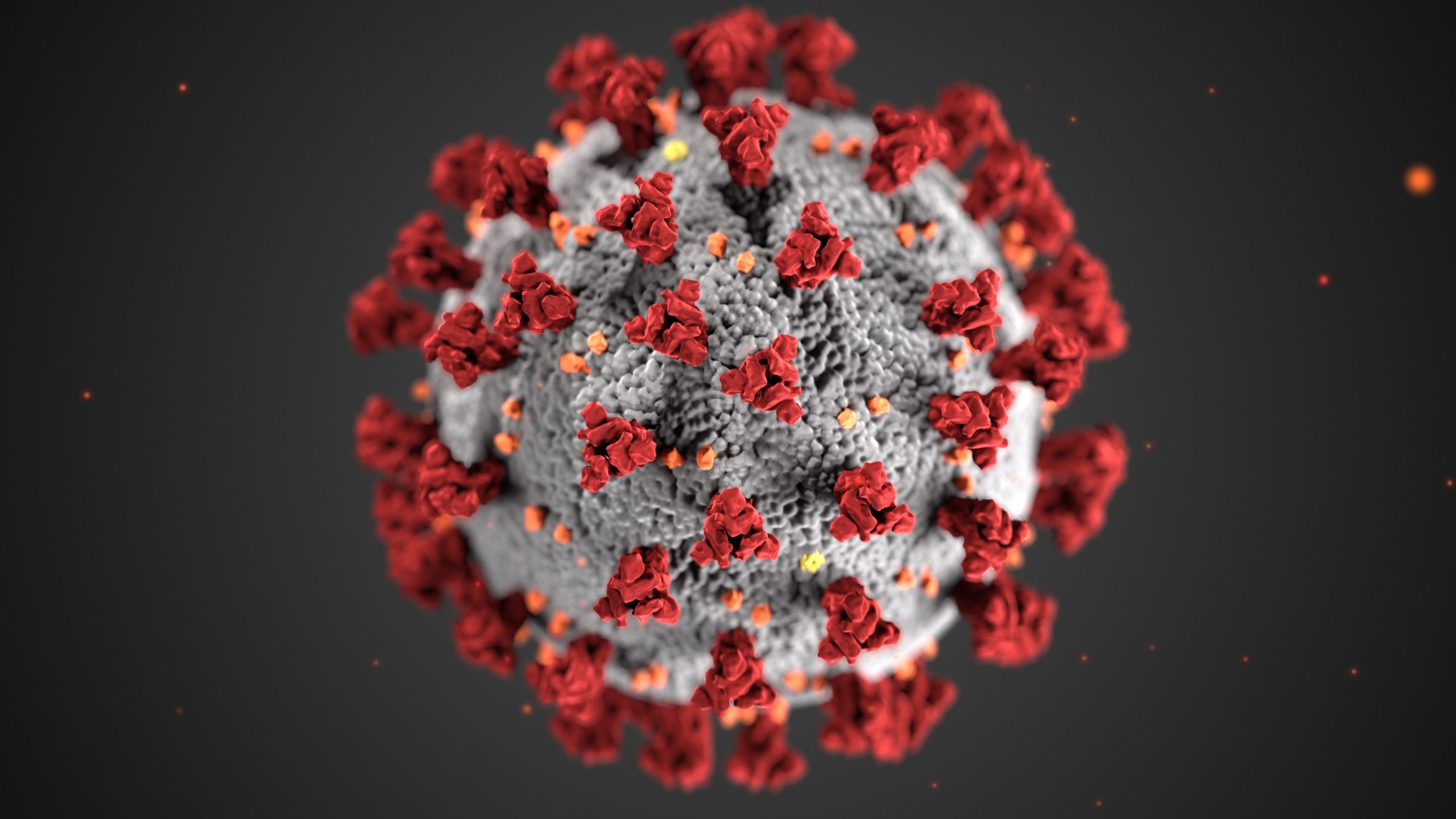

Read MoreCOVID-19 and Trade Associations: The Impact So Far

Summary of Keypoints COVID-19 has caused significant financial losses for trade associations, primarily due to cancellations of in-person conferences and events, which typically account for about 35% of annual association revenue. Membership dues revenue has also declined as member organizations reduce expenses, compounding the financial strain caused by event cancellations. Survey data from the American…

Read MoreTop 7 reasons companies Outsource Accounting and Back-office functions

By Jennifer Eubanks 1. Competent financial management, reporting, and guidance. Businesses need to have competent financial management, reporting, and guidance so the management team can focus on operations. 2. Businesses need the right people. Some 70 percent of KPMG survey respondents said they are outsourcing accounting to get access to better talent. This helps clients focus on their business instead…

Read MoreAccounting Outsourcing… Leading the New Normal

Summary of Keypoints Shift in work environment: COVID-19 and widespread work-from-home adoption demonstrated that productivity and business continuity can be maintained without full-time, in-office staff, prompting companies to rethink traditional operating models. Case for accounting outsourcing: As leadership increasingly relies on timely, accurate financial data, outsourcing accounting and finance functions offers access to professional financial…

Read More5 Steps to Setting Up a US Company for Non-US Resident

Summary of Keypoints Why form a U.S. company: Establishing a business in the United States offers advantages for non-U.S. residents, including lower relative taxes, easier access to the U.S. market, strong legal protections, and the global credibility associated with U.S.-based companies. Step 1 – Choose a business structure: Foreign nationals can form a Corporation (C-Corp)…

Read MoreFairfax County Help For Businesses due to Covid-19

Summary of Keypoints Overview of Fairfax County business assistance: Fairfax County provides COVID-19-related relief measures aimed at supporting local businesses impacted by the pandemic. Tax deadline extensions: Fairfax County extended deadlines for certain local taxes, including car (business personal property) taxes and real estate taxes, to help ease short-term cash flow pressures for businesses. Purpose…

Read MoreFamilies First Emergency Family and Medical Leave Expansion Act

Summary of Keypoints Overview of Families First emergency leave requirements: The Families First Emergency Family and Medical Leave Expansion Act (EFMLEA) and the Emergency Paid Sick Leave Act (EPSLA) require employers with fewer than 500 employees to provide paid leave related to COVID-19, with potential exemptions for employers with fewer than 50 employees if compliance…

Read MoreSBA EIDL Help for Small Businesses

Summary of Keypoints Overview of SBA Economic Injury Disaster Loans (EIDL): Under the Coronavirus Preparedness and Response Supplemental Appropriations Act of 2020, the SBA provides low-interest federal disaster loans to small businesses experiencing substantial economic injury due to COVID-19. Loan purpose and use of funds: EIDL proceeds may be used for working capital needs, including…

Read More