Government Contractors

The Cost of Non-Compliance: How FAR & CAS Compliance Mistakes Can Undermine Your Entire Contract Strategy

Summary of Keypoints FAR and CAS non-compliance can eliminate opportunities before award or destroy profitability after award, causing proposal rejections, cost disallowances, billing suspensions, or forced contract type changes that undermine otherwise strong technical performance. Common compliance failures include indefensible indirect rate structures, double-charging costs, and inclusion of unallowable expenses, which lead to proposal inadequacy…

Read MoreWhen Financial Planning Ignores CAS Standards

Summary of Keypoints Not being formally CAS-covered does not eliminate CAS-related risk, because early financial planning choices can create cost structures that later become expensive to unwind and can still trigger DCAA scrutiny during proposals, pre-award surveys, and accounting system reviews. CAS coverage is described as kicking in through CAS-covered awards thresholds, with full coverage…

Read MoreHow to Build a Forward Pricing Rate Proposal (FPRP) That Survives DCAA Review and Wins Contracts

Summary of Keypoints A Forward Pricing Rate Proposal (FPRP) establishes pre-reviewed indirect rates for future proposals and billing, allowing contractors to avoid rebuilding rate justifications for every bid and giving contracting officers confidence in pricing for cost-reimbursement, T&M, and IDIQ contracts. An FPRP is built on verifiable historical cost data adjusted for documented future changes,…

Read MoreFAR & CAS Compliance Is the Backbone of Your Financial Strategy

Summary of Keypoints FAR and CAS compliance governs nearly every financial aspect of government contracting, including allowable costs, indirect rate structures, proposal pricing, billing practices, audit standards, and accounting system design, making it the foundation of whether and how contractors get paid. Contractors often treat compliance as an afterthought, delaying attention until audits, questioned costs,…

Read MoreUnderstanding the Difference Between Cost Proposals and Pricing Proposals and Why Getting It Wrong Could Trigger a Rejection

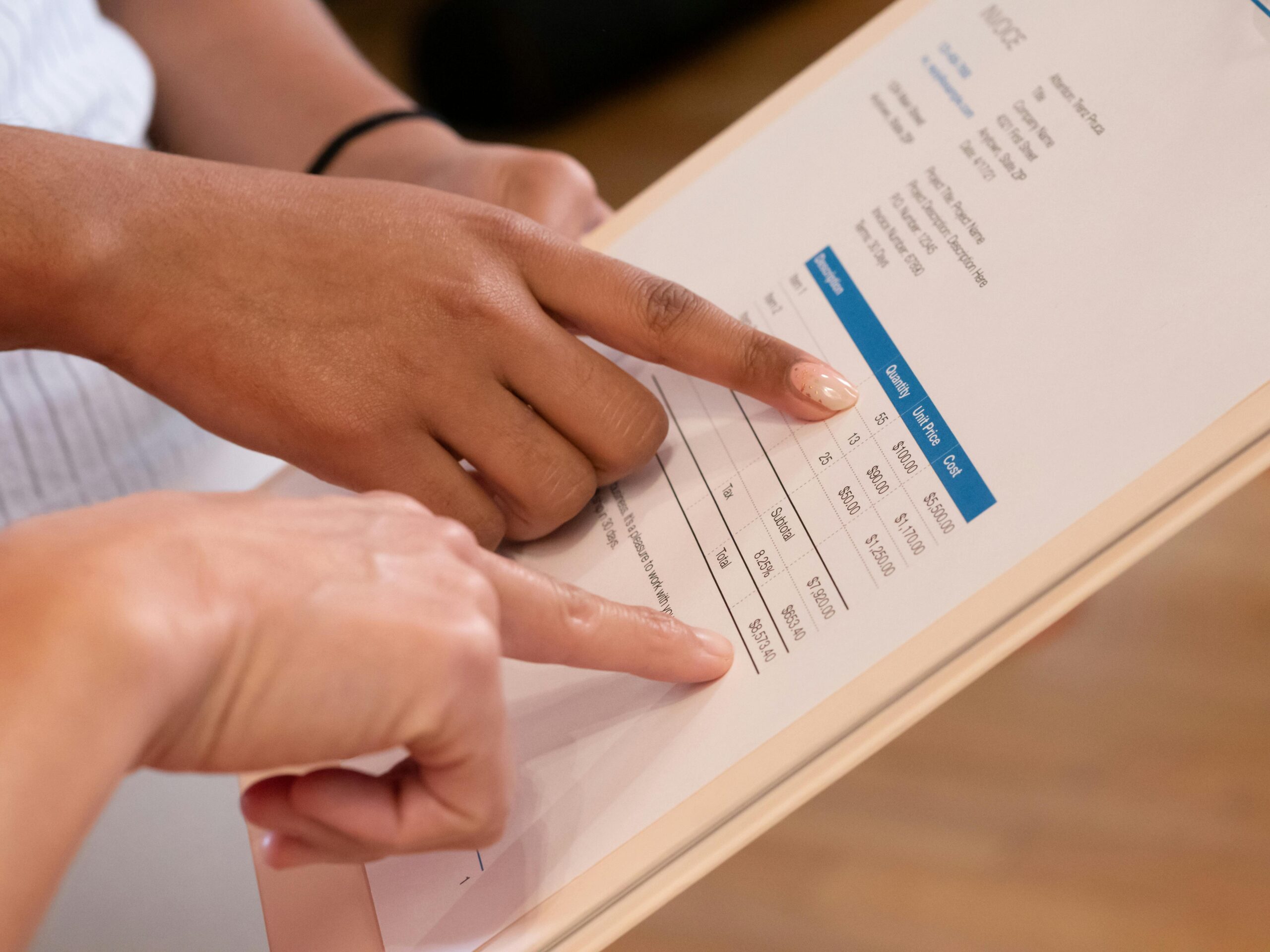

Summary of Keypoints Cost proposals and pricing proposals are not interchangeable, and submitting the wrong one is a common reason for proposal rejection, even when the numbers themselves are reasonable. Cost proposals require full cost transparency and detailed buildup, including labor by category and hour, fully supported indirect rates, subcontractor cost data, other direct costs…

Read MoreHow to Use Historical Costs to Justify Forward Pricing: A GovCon Guide to Data-Driven Bids

Summary of Keypoints Historical cost data is the foundation of defensible forward pricing, because FAR 15.404-1 requires agencies to assess cost realism by comparing proposed costs to verifiable past performance, not estimates or intuition. Well-maintained historical costs reveal true cost behavior, including actual labor productivity, indirect rate trends, differences between contract types, and subcontractor or…

Read MoreThe 5 Most Common Mistakes in Government Proposal Pricing (and What DCAA Is Actually Looking For)

Summary of Keypoints The most common proposal pricing failures stem from misunderstanding what DCAA evaluates, not from bad math, and include unsupported indirect rates, labor rates that don’t match payroll data, weak subcontractor cost analysis, inclusion of unallowable costs, and missing or vague bases of estimate. DCAA expects proposed costs to reconcile to real accounting…

Read MoreThe Pre-Audit Checklist Every Government Contractor Should Tackle Before Year-End

Summary of Keypoints Year-end (October–November) is the optimal window for audit readiness, allowing contractors to reconcile provisional billing rates to actuals, document variances, and correct issues before DCAA or IRS scrutiny begins. Key compliance focus areas include indirect rate accuracy and FAR Part 31 allowability, requiring contractors to review fringe, overhead, and G&A recovery, segregate…

Read MoreWhat Happens When You Underprice a Proposal and How a Government Contracts Advisor Can Help

Summary of Keypoints Underpricing proposals creates long-term business risk, often leading to collapsed profit margins, staffing instability, degraded performance, and damaged past performance records, even when the low price initially wins the contract. Government evaluators assess price realism, not just lowest price, especially for cost-reimbursement and certain fixed-price contracts, to determine whether proposed costs are…

Read MoreWhy Your Forward Pricing Rates Are Costing You Contracts (and How to Fix Them)

Summary of Keypoints Forward pricing rates can be fully approved yet still undermine competitiveness, because DCAA approval confirms adequacy and compliance—not whether rates position a contractor to win best-value awards. Overstated or outdated indirect rates inflate fully burdened labor costs, leading to uncompetitive cost volumes, inconsistent win rates, and contracts that strain margins despite strong…

Read More