SBA EIDL Help for Small Businesses

Summary of Keypoints

- Overview of SBA Economic Injury Disaster Loans (EIDL): Under the Coronavirus Preparedness and Response Supplemental Appropriations Act of 2020, the SBA provides low-interest federal disaster loans to small businesses experiencing substantial economic injury due to COVID-19.

- Loan purpose and use of funds: EIDL proceeds may be used for working capital needs, including payroll, fixed debts, accounts payable, and other ordinary business expenses that could have been paid if the disaster had not occurred.

- Eligibility criteria: Eligibility is based on the size and type of business and the ability to repay the loan, with certain entities such as agricultural enterprises, religious organizations, and charitable organizations listed as ineligible, and a complete eligibility list available through SBA disaster loan resources.

- Application terms and flexibility: There is no cost to apply, no obligation to accept a loan if approved, and applicants may qualify for a COVID-19 EIDL even if they already have an existing SBA disaster loan.

- Application process and documentation: Small businesses may apply online or seek assistance with the application process, with required SBA forms and supporting documentation referenced for completion.

Economic Injury Disaster Loan (EIDL) from the SBA

The Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020

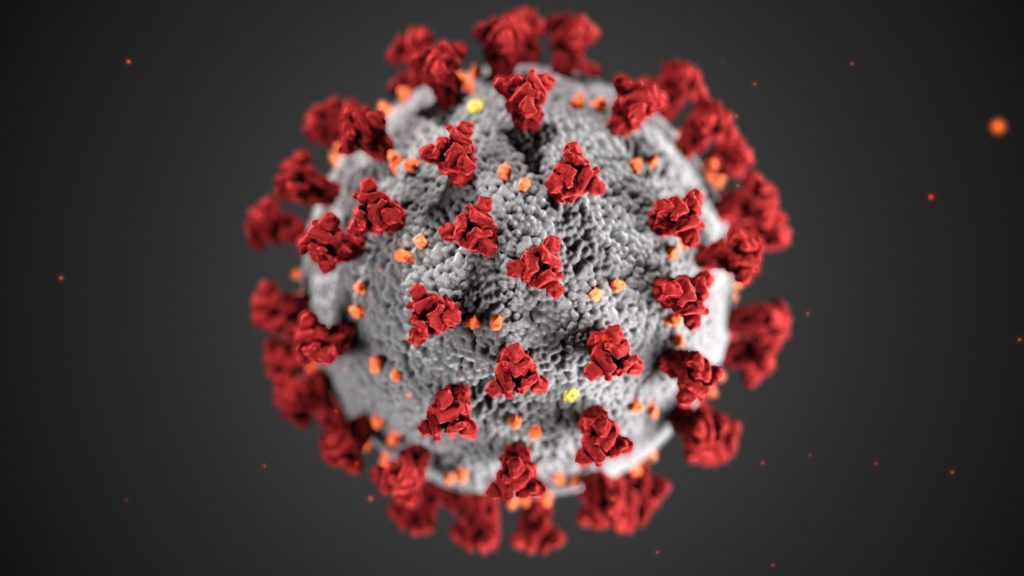

Providing help to small businesses through the U.S. Small Business Administration (SBA) through low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19).

Read an overview of loan eligibility and terms

Loan Purpose: funding of working capital needs, pay fixed debts, payroll, accounts payable, and other bills that could have been paid had the disaster not occurred.

Eligibility: based on size and type of business (must be a small business) and the business’ financial resources to repay the loan. Agricultural enterprises, religious organizations and charitable organizations are among the organizations that are ineligible. For a complete list visit DisasterLoan.sba.gov

Details:

There is no cost to apply

No obligation to take the loan if offered

Applicants qualify for an EIDL for the Coronavirus (COVID-19) disaster even if they have an existing SBA Disaster Loan

Application: Call us for help or apply online here: https://www.sba.gov/funding-programs/disaster-assistance